In today’s banking sector, countering financial crime has emerged as a paramount security concern. The regulatory landscape, rather than internal bank policies, largely determines the requirements in this domain. Non-compliance with these regulations can result in substantial fines and severe damage to a company’s reputation. To proactively prevent such incidents, modern banks have embraced a customer relationship policy founded on Know Your Customer (KYC) principles.

Recognizing the significance of KYC, banks, investment firms, and financial companies are actively investing in the development of innovative solutions, forging partnerships with dynamic FinTech startups. Let’s explore the emergence of identification methods that have stemmed from this fruitful collaboration, specifically targeted at subject matter experts in the banking and fintech industries.

The Critical Role of KYC

In a rapidly growing economy, financial institutions are vulnerable to criminal activities. Alongside offering services, these entities must adhere to regulations that safeguard the financial resources and data of their customers against fraud.

While trade in goods and services typically involves risk insurance determined by contractual terms, the financial sector must incorporate security measures within its own instruments. Although no universal standards define these measures, they generally vary depending on the financial services company responsible for establishing an effective security policy. Government agencies combating financial crimes issue and monitor compliance with specific regulations. One such pivotal regulation is Know Your Customer (KYC), introduced by the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) in the early 2000s.

KYC is a method employed by companies, particularly banks, to verify the identity of their clients in accordance with legislative requirements and anti-money laundering regulations. It encompasses personal identification, understanding the client’s activities and the source of their funds, as well as assessing the risks associated with potential money laundering.

As we navigate through an era of rapid technological advancements, the demands placed on KYC procedures are intensifying. Stricter financial crime regulations compel banks to allocate significant resources and time to security solutions. However, while resource allocation poses challenges for financial companies, clients often face inconveniences and time-consuming processes during the identification phase, resulting in frustration.

Thankfully, with technological advancements and the advent of the pandemic, neobanks and fintech companies have embraced digital identity options, automating their processes. This shift has had a positive impact on financial services, allowing clients to remotely provide data via secure channels without the need for physically visiting a bank branch. Although implementing seamless digital onboarding solutions can be costly, the rewards are well worth it.

Enhancing Onboarding Experiences

To recap, the KYC procedure aims to verify that a client’s claims about their identity are genuine, granting them access to the desired services. Various methods facilitate this verification, with the financial institutions having the liberty to choose the most suitable approach.

Given that lengthy questionnaires and complex checks can deter potential customers, financial services companies face the challenge of simplifying identification methods while maintaining reliability and adhering to high standards and prevailing regulations.

Source: Finextra

The advent of electronic identification, known as eKYC, offers a significant time-saving advantage to clients seeking financial services. Leveraging photo or video identification, this modern practice streamlines the process of receiving desired services. Furthermore, the best practice for connecting clients to bank services, known as multi-level KYC, adopts a flexible approach in which the user verification procedure is determined by the specific service being requested. For example, clients seeking to explore financial products and services may be exempt from full KYC requirements, while those applying for loans or engaging in significant transactions may need to provide additional verification documents.

This tailored approach contributes to an exceptional user verification experience, encompassing the following key components:

- Multi-level Onboarding: This flexible approach enables new clients to explore available financial services without undergoing identity verification. However, to access a specific financial service, verification becomes mandatory.

- Balanced KYC Compliance: Financial companies must strike a balance between meeting requirements for combating financial crime and delivering an excellent customer experience. They must carefully select procedures and risk policies to achieve this equilibrium.

- Customer Benefits: KYC compliance not only protects financial institutions from the risks associated with financial activities but also reassures customers that their personal information and funds remain secure and accessible only to them.

Revolutionary KYC Methods

The development of financial and banking technologies has paved the way for innovative KYC methods. Let’s delve into five of the most prominent methods:

1. In-person Manual KYC:

Before the advent of digital solutions, KYC compliance necessitated in-person verification (IPC), wherein clients met with bank representatives in face-to-face meetings and submitted required documents. Although some countries and companies still rely on this practice for specific financial services, it is becoming less prevalent as banking systems adopt technologies like streaming video, enabling remote identity confirmation.

Additionally, secure file-sharing features eliminate the need for clients to physically deliver documents, as more companies embrace a paperless approach, accepting digital forms of ID, proof of residence, and other necessary documents.

2. Automated eKYC Method:

The manual KYC process has transitioned into eKYC, digitizing the identity verification process for companies at the forefront of technological advancements. Fintech companies leverage technologies like artificial intelligence (AI) and machine learning (ML) to revolutionize KYC practices, ensuring enhanced compliance.

For instance, corporate-level software utilizes Optical Character Recognition (OCR) and ML algorithms to verify electronically submitted documents and photos. This approach ensures that documents obtained for identity verification are genuine and belong to the respective client. Alaqsat, for instance, offers an integrated Liveness detection and face recognition tool that detects potential fraud in the early stages, thereby enhancing the security of the eKYC/AML verification process.

Automated eKYC/AML verification surpasses manual verification in numerous aspects, eliminating human errors, improving the customer experience, and reducing costs.

3. KYC and Verification through Open Banking:

Open banking has emerged as a game-changer for banks and financial services companies, facilitating the integration of third-party providers via APIs and enabling the delivery of value-added services to customers. Banks can leverage data obtained from third-party services used by customers to gain a deeper understanding of their needs, conduct thorough underwriting, and perform AML/KYC checks.

With access to data from various sources, FinTech companies no longer need to start from scratch when collecting and interpreting data. Consequently, verifying customer identities has become easier, safer, and more cost-effective.

KYC-enabled open banking benefits customers too, granting them access to banking services with a single click, bypassing the need for lengthy in-person or eKYC verification processes.

4. Phone Identity Verification:

Mobile phones provide valuable insights into their owners’ profiles, making them invaluable for identity verification purposes. Mobile identity technology simplifies the KYC verification process, leading to an improved onboarding experience.

Moreover, mobile phone verification offers accuracy. Data related to phone behavior, including calls, SMS, SIM card changes, phone line activities, and even contact lists, is monitored and analyzed to determine if clients are involved in suspicious transactions.

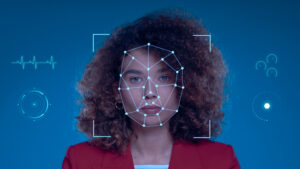

5. Biometric Identification for Enhanced KYC:

FC-enabled phones equipped with biometric sensors have become an additional solution for identity verification. This method stands out due to its accessibility and efficiency. Clients only need a device supporting biometric sensors to access financial services. They can scan their eyes or fingerprints or utilize facial recognition to verify their identity and gain access to their accounts or utilize banking products.

An integral component of the biometric authentication system is liveness detection technology, which Alaqsat incorporates into its modules. This technology distinguishes between “real” individuals and fraudsters using fake IDs, such as face photos, videos, realistic masks, or deepfakes.

Conclusion

User authentication and identification pose significant challenges for numerous financial services. Fintech companies strive to provide seamless authentication experiences within their services and applications. However, simplifying these procedures must not compromise security.

Modern technologies have unlocked previously unattainable KYC methods, particularly in the realm of biometrics. Computer systems now recognize individuals through facial, retinal, vocal, or fingerprint recognition.

This crucial aspect of the financial industry continues to evolve, with further advancements in KYC solutions on the horizon. These innovations will enhance user experiences and deliver more personalized offers, ensuring a secure and seamless journey for subject matter experts in banks and fintechs.