Alaqsat- Lending on the Go!

Alaqsat is a transformative platform that redefines the buy now pay later experience, providing an immersive ecommerce journey, comprehensive backend management, and real-time integration capabilities

A Platform to Automate the BNPL Process

Introducing Alaqsat, the revolutionary platform that transforms the buy now pay later experience offered by banks. Our interactive product details with rich content replace PDF catalogues and manual orders, providing a seamless ecommerce journey. With convenient instalment options for both new and existing customers, transactions are effortlessly split at the time of order placement through API integration. Features like eKYC, credit engine integration, and virtual card generation ensure a frictionless onboarding process

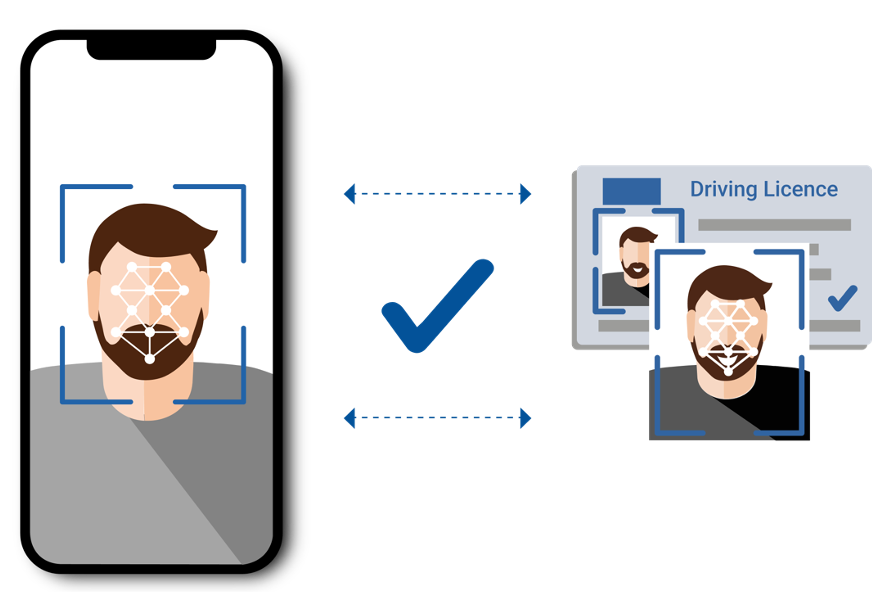

AI Powered KYC & Identity Verification Tool

Our identity and verification product is a comprehensive solution designed for use in a variety of industries, including banking and fintech. It is designed to meet the needs of organizations that must comply with Know Your Customer (KYC) regulations and streamline digital onboarding processes.

The product uses advanced AI, OCR, and computer vision technologies to accurately and efficiently scan and verify government-issued identification documents, including passports, driver’s licenses, and ID cards. The OCR technology captures the personal information from the identification card and matches it with the user.

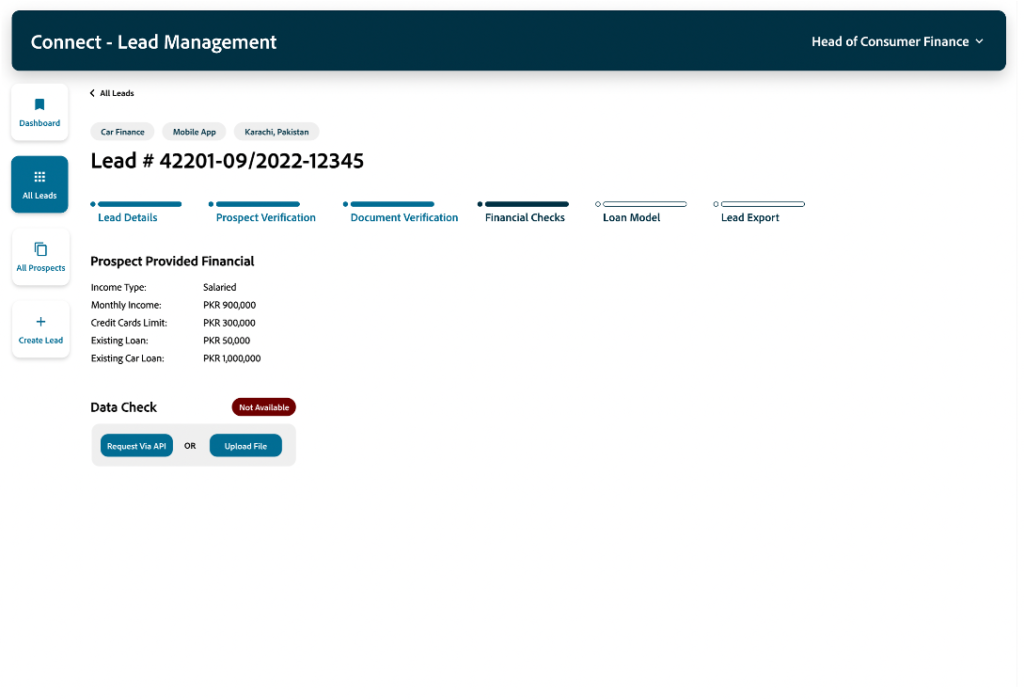

Credit Bureau Integration & Credit Assessment

The platform enables the financial institute to connect with the Credit Bureau to fetch relevant information about the user. The financial institute can define rules and formula based on these values to calculate the credit limit and/or the credit score. Based on these limit/score, bank can

E-Commerce Module - Catalog Management

Alaqsat also provides an online/interactive e-commerce like modeule that can be integrated into Bank;s website, Mobile app and Facebook Page. On that portal the bank users can easily navigate the options in different categories.

Customers can filter the Installment Plan Catalogue via Categories, Price of the products & Brand/Manufacturer.

Calculator to determine the 0% markup and applicable markup as per the defined schedule to share by the bank.

Product Details be like Title, Description, Key Attributes, Picture Gallery, Video, 360-view, Manufacturer Link to Detail Specs.

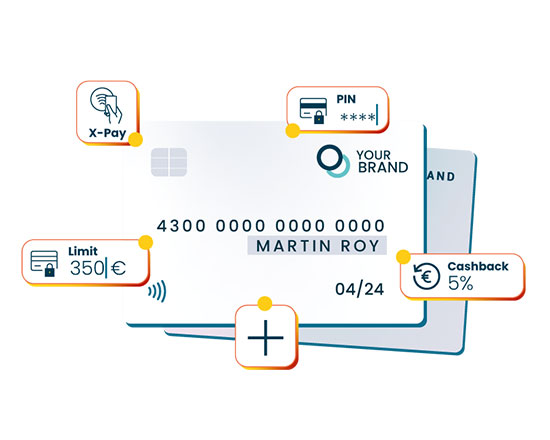

Card Enabled BNPL

- For New Bank Customers: Out-of-the-box integration with virtual and physical card issuing providers (VISA/MasterCard) and systems.

- Provide all necessary AML & KYC checks for the card issuer.

- For Existing Customers: Utilising the credit limit.

- Engage split before or after the transaction at checkout

- Automatically transfer data to Core Banking System

- Mass sendings and pre-collection reminders

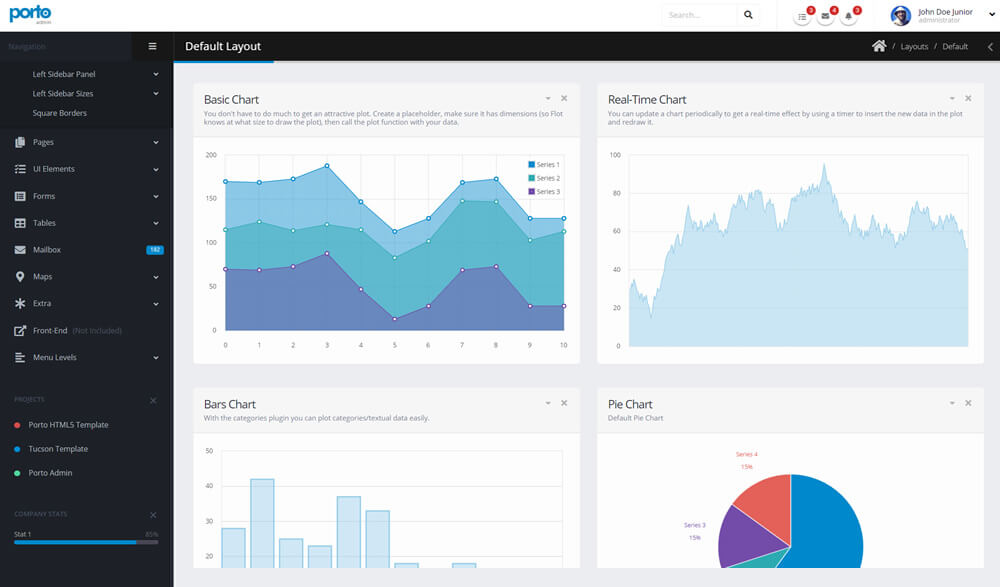

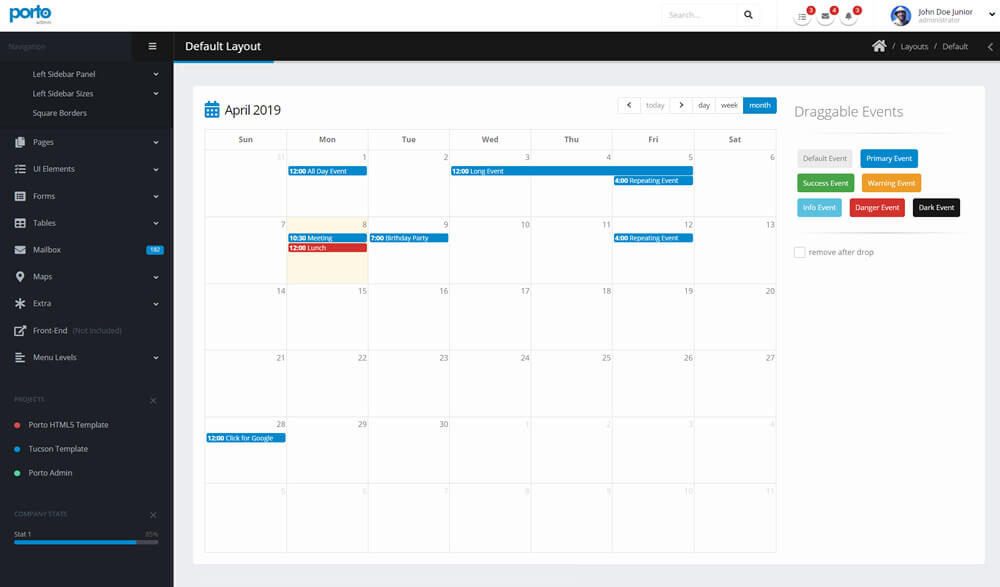

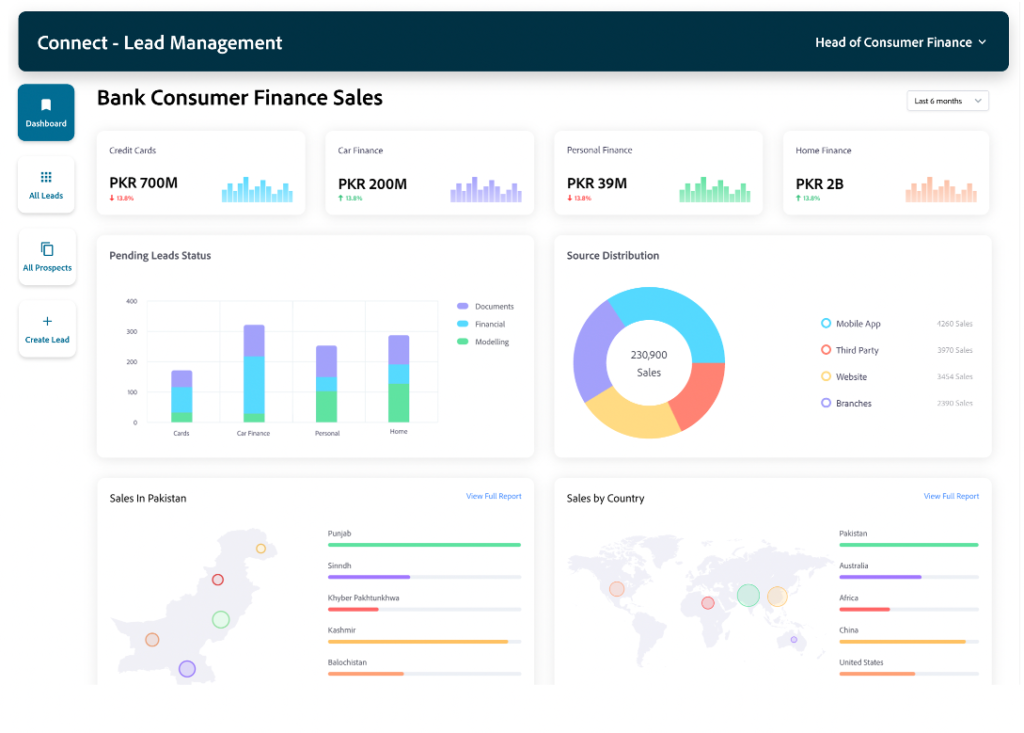

Dashboard & Reporting

A comprehensive dashboard to gain a 360° view of institution’s processes, pipelines etc.

It will provide a snapshot of transactions, payments and all other relevant information.

Moreover, the portal will have all the required basic reporting for bank’s internal compliance and for regulators. The users will be able to export CSV and PDF versions of these reports.

Frequent Asked Questions

Alaqsat, a game-changing platform that revolutionizes the Buy Now Pay Later experience offered by banks.

We eliminate the tedious process of PDF catalogs, and manual orders by transforming them into interactive product details with rich content, providing a seamless ecommerce experience.

Whether for existing or new customers, our platform enables convenient instalment purchases on the go. These transactions are effortlessly split at the time of order placement.

With features like eKYC, credit engine integration with credit bureaus, and virtual card generation, we ensure a frictionless onboarding process.

Our comprehensive backend portal empowers banks to efficiently manage merchants, product availability, pricing, commissions, returns, and all aspects of BNPL operations. Additionally, we offer real-time integration options with merchant systems (CMS plugins and APIs) for real time inventory & prices updates.

You can define the journey at the time of the integration. Defining the parameters and flow of customer onboarding, then setting up the rules and limits for credit scoring. Once the credit scoring is defined, you can setup the criteria’s and mapped it with the credit limit. Lastly, connect the core banking system for instalments and payments.

Alaqsat provides you the liberty to host the solution at banks’s premises or on your private cloud. Also, you can use our hosting services. We host our solution at AWS.

We are open for integrations as far as these Credit Bureaus have their APIs available.

Book a Demo

Please share your requirements and we can walk you through our tool.

Blogs

Revolutionizing KYC Solutions for Banks and Fintechs

In today's banking sector, countering financial crime has emerged as a paramount security concern. The regulatory landscape, rather than... read more